Property foreclosure is a situation in which a homeowner is unable to make full principal and interest payments on his/her mortgage, which allows the lender to seize the property, evict the homeowner and sell the home, as stipulated in the mortgage contract. One month after the homeowner misses a home loan payment, he/she is in default and will be notified by the lender. Three to six months after the homeowner yearns for a mortgage payment, supposing the mortgage is still delinquent, and the homeowner has not made up the missed payments within a particular grace period, the lending company will start to foreclose. The farther behind the customer falls, the more difficult it becomes to get up since lenders add fees for payments that are 10 to 15 days past due.

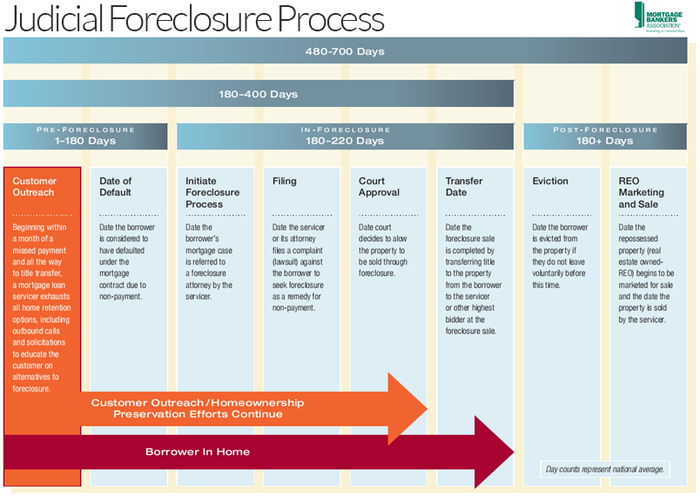

Each state has their own foreclosure laws covering the notices the lender must post publicly and/or with the homeowner, the homeowner's options for bringing the loan current and avoiding foreclosures, and the process for selling the property. In twenty-two states – including Florida, Illinois, and New York : judicial foreclosure is the norm, meaning the lender must go through the courts to get agreement to foreclose by proving the borrower is delinquent.

If the foreclosure qualifies, the local sheriff online auctions the property to the greatest bidder to try and recoup what the bank is payable, or the bank becomes the owner and markets the home through the traditional route to recoup its loss. The entire legislativo foreclosure process, from the borrower's first, missed payment through the lender's sale for the home, usually will take 480 to 700 times, in accordance with the Mortgage Bankers Organization of America.

The other 28 states – including Arizona, California, Georgia and Texas – mainly use non-judicial foreclosure, also called the power of sale, which is often faster and really does not go through the courts unless the homeowner sues the lender.

Another Image of Foreclosure Redeemed:

The Definitive Guide To Bank Foreclosures

Komentar

Posting Komentar